Stock screening helps you quickly find investment opportunities by filtering stocks based on criteria like market cap, P/E ratio, and growth metrics. It saves time, ensures data-driven decisions, and aligns with your goals. Beginners can start with free tools like Finviz or Yahoo Finance and apply filters for valuation, growth, and risk. Use metrics such as P/E ratio (10-25), ROE (above 15%), and debt-to-equity (below 1.0) to identify stable, profitable companies. Remember, stock screening is just the first step - always follow up with detailed research before investing.

Key Takeaways:

- Use stock screeners like Finviz, Yahoo Finance, or TradingView.

- Apply filters: Market cap > $1B, P/E ratio 10-25, ROE > 15%.

- Evaluate results and research further before making decisions.

- Save filter settings to streamline future searches.

Pro Tip: Combine fundamental metrics (e.g., P/E ratio) with growth indicators (e.g., revenue growth) for a balanced strategy.

Selecting a Stock Screener

Popular Stock Screeners Overview

Starting your investment journey? Picking the right stock screener can make all the difference. Here are some popular options to consider:

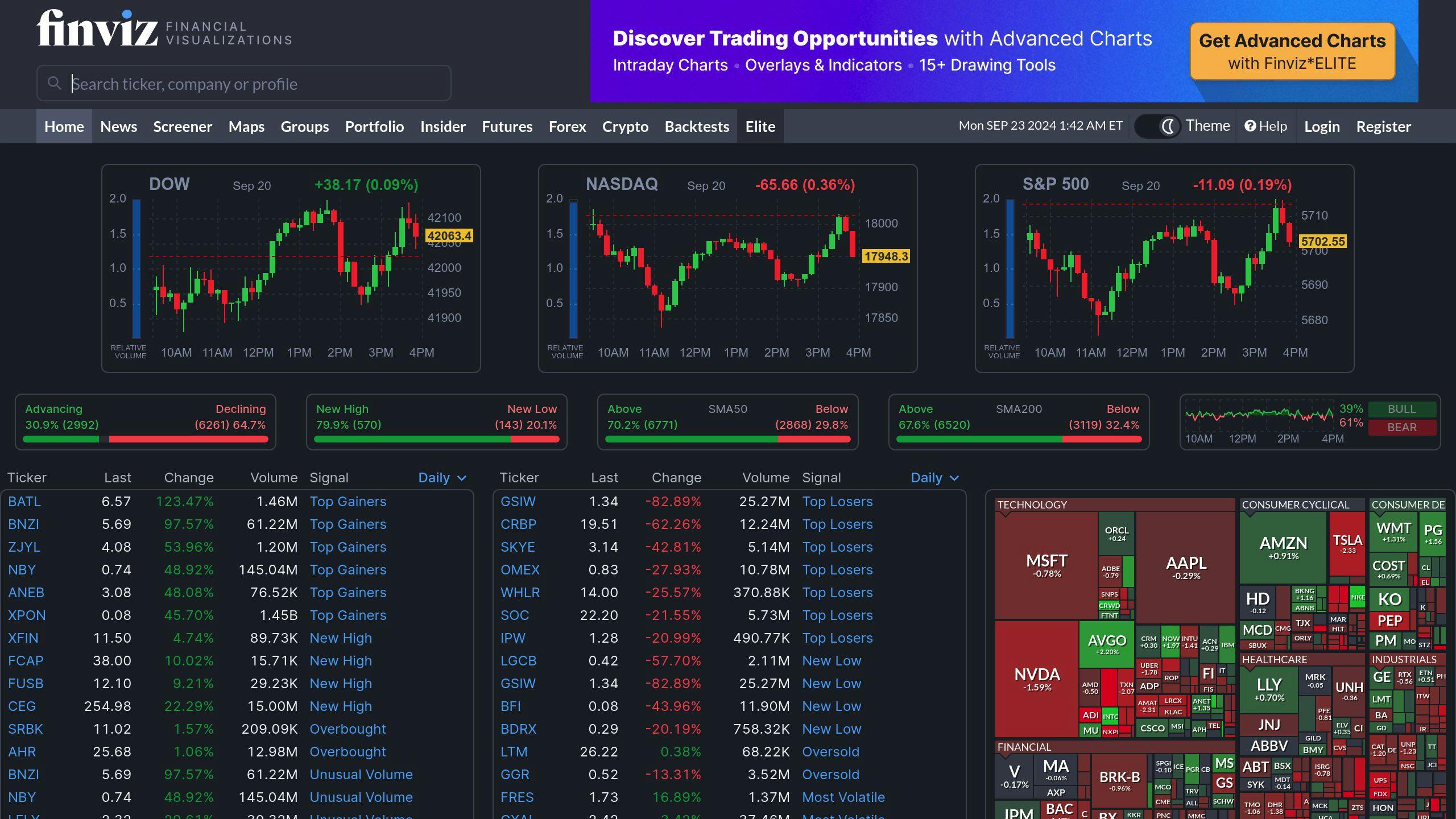

- Finviz: Known for its simple tools and easy-to-use filters, this platform is perfect for beginners. The free version offers key filters like market cap, P/E ratio, and dividend yield, along with helpful visualizations.

- Yahoo Finance: This platform combines a straightforward interface with a mix of traditional metrics and filters focused on sustainability, catering to modern investment preferences.

- TradingView: Beyond just screening stocks, TradingView lets you connect with a community of investors, enabling you to share insights and learn collaboratively. It covers over 50 exchanges worldwide.

- Stocks to Buy Constellation: If you're curious about AI-driven tools, this platform offers advanced analysis that even beginners can explore.

Choosing a Stock Screener: Key Factors

When deciding on a stock screener, keep these factors in mind:

| Factor | What to Look For | Example Platform |

|---|---|---|

| User Interface | Simple, intuitive design | Finviz |

| Data Quality | Accurate, up-to-date information | Yahoo Finance |

| Cost Structure | Free options available | TradingView |

| Filter Options | Basic and customizable filters | StockFetcher |

Educational Tools: Opt for platforms that offer guides, tutorials, or community features to help you make sense of the data.

Filter Variety: Start with simple filters - price, P/E ratio, or market cap. As you gain confidence, try platforms with more advanced options to refine your strategy.

Free platforms are a great starting point for beginners, offering everything you need to learn stock screening basics. As your skills grow, you can explore more advanced tools to match your evolving investment goals. Once you've chosen a screener, it's time to set up filters that align with your strategy.

Using a Stock Screener: A Step-by-Step Guide

Setting Up Filters

To get started, apply these basic filters to narrow your search:

| Filter Category | Recommended Range | Purpose |

|---|---|---|

| Market Cap | Above $1 billion | Focus on well-established companies |

| P/E Ratio | 10-25 | Spot stocks with reasonable valuations |

| ROE | Above 15% | Look for companies with strong profitability |

| Debt-to-Equity | Below 1.0 | Identify financially stable businesses |

If you're using tools like Finviz or Yahoo Finance, here's how to refine your search:

- Growth Indicators: Add filters for revenue growth (at least 10% annually) and earnings growth (at least 15% annually) to find companies showing strong momentum.

- Industry Selection: Use sector filters to focus on industries of interest, like technology or healthcare.

Analyzing Screening Results

Once you've applied your filters, the screener will generate a list of potential stocks. Here's how to evaluate them:

- Step 1: Adjust Results: If your list is too long (over 50 stocks) or too short (fewer than 5), tweak your filters to refine the output.

- Step 2: Research Further: Look into price trends, recent news, and the company’s standing in its industry.

- Step 3: Validate Choices: Dive into financial statements, earnings reports, and broader industry trends to confirm whether a stock is worth considering.

Stock screeners are a great starting point, but they’re only part of the process. Always follow up with detailed research before making investment decisions.

Pro Tip: Save your filter settings to speed up future searches.

Important Metrics for Stock Screening

Valuation Metrics Explained

Knowing the right valuation metrics can help you make smarter investment choices. Here are a few key ones to keep in mind:

| Metric | Description | Typical Range |

|---|---|---|

| P/E Ratio | Measures how much investors pay for earnings | 10-25 for stable companies |

| P/S Ratio | Compares price to sales | Below 2 for value stocks |

| ROE | Tracks profitability based on shareholder equity | Above 15% suggests strong performance |

The Price-to-Earnings (P/E) ratio tells you how much investors are willing to pay for a company's earnings. For example, a P/E ratio of 15 means investors pay $15 for every $1 of earnings. Keep in mind, though, that P/E ratios are most useful when comparing companies in the same industry.

Return on Equity (ROE) is another important metric. It highlights how well a company uses shareholder funds to generate profit. An ROE above 15% often signals efficient management and solid profitability.

While these metrics focus on a stock's current value, it's equally important to look at growth metrics to gauge its future potential.

Growth Metrics Overview

Growth metrics help you spot companies with room to expand. Pay attention to the following:

Revenue Growth:

- Look for consistent year-over-year growth above 10%.

- Compare growth rates to industry averages.

- Favor companies with steady, predictable growth patterns over erratic ones.

The Price-to-Earnings Growth (PEG) ratio is a handy tool for combining valuation with growth potential. A PEG ratio below 1.0 may indicate that a stock is undervalued relative to its growth. For instance, a P/E of 20 and earnings growth of 25% results in a PEG of 0.8, which could signal a good buying opportunity.

Earnings Growth Indicators:

- Aim for steady earnings-per-share (EPS) growth of at least 15% annually.

- Look for consistent upward trends in earnings.

- Avoid stocks with highly volatile earnings.

sbb-itb-5d8d242

Full Finviz Tutorial for Beginners

Advanced Stock Screening Techniques

Traditional stock screeners use fixed filters, but AI-powered tools go further by analyzing massive datasets and spotting patterns that humans might miss.

AI-Powered Stock Screening Tools

AI tools are great for investors who want to explore hidden opportunities or quickly analyze complex data. They simplify the process for beginners while minimizing the risk of missing important details.

Stock Rover offers access to over 650 metrics, helping investors make data-driven decisions and pinpoint promising stocks with ease.

The Stocks to Buy Constellation platform evaluates 3,000 U.S. stocks daily using a unique analysis system. Here's a quick breakdown of its pricing and features:

| Plan | Monthly Price | Key Feature |

|---|---|---|

| Basic | $9 | Daily data updates |

| Growth | $19 | Portfolio tracking |

| Premium | $49 | Unlimited reports |

Customizing Stock Screens

Whether you're using traditional or AI-driven tools, customizing your stock screens ensures they align with your specific investment goals. The real power lies in combining different metrics in a thoughtful way.

On platforms like Finviz, try pairing fundamental metrics with technical indicators. For instance, use P/E ratios alongside Relative Strength Index (RSI) to find undervalued stocks with strong momentum. Save your custom screens to keep your strategy consistent.

Pro Tip: Mix valuation metrics with momentum indicators for a balanced approach. This can help you find stocks that are not only financially stable but also attracting market interest.

Conclusion and Next Steps

Key Points Summary

Stock screening is a powerful tool for investors aiming to uncover potential opportunities in the market. By blending fundamental metrics with technical analysis, you can develop a balanced approach that captures both value and momentum. Platforms like Finviz and Yahoo Finance make it easy for beginners to start, offering straightforward and accessible features at no cost.

The real key to success lies in understanding how to interpret these metrics and choosing the right tools to support your strategy. A systematic approach that integrates both fundamental and technical insights can help you pinpoint stocks that match your specific investment goals.

Now it's time to take what you've learned and apply it.

Encouraging Practice

Start small. Use free tools to screen stocks based on basic metrics like market capitalization, debt ratio, and profitability indicators. Once you feel more confident, move on to advanced platforms that allow for deeper analysis. Joining communities on platforms like TradingView can also provide valuable insights, as you can learn from experienced investors and share your own findings.

As experts remind us:

"Stock screening is just the first step in the investment process and should be followed by thorough research and analysis" [3].

Improving as an investor is an ongoing process. Stay updated on market trends, refine your screening techniques, and adapt your criteria to reflect changes in the market and your own financial goals. With consistent practice and a commitment to learning, you'll gain the skills needed to navigate the stock market with confidence.

Patience, continuous learning, and thorough research are the foundations of successful investing. By combining regular practice with diligent analysis, you’ll be well-equipped to create a strategy that aligns with your financial aspirations.

FAQs

Here are answers to common questions beginners often have about stock screening.

How can beginners use a stock screener?

Using a stock screener can be simple if you follow these basic steps:

- Focus on large-cap stocks (over $10 billion) for more stability.

- Compare P/E ratios to industry averages to spot potential value.

- Check dividend yields if earning income is a priority.

- Look for companies with consistent positive earnings growth.

Keep in mind, stock screening is just the starting point. You'll need to conduct deeper research before making any investment decisions.

What are the key metrics for beginners to focus on?

As a beginner, prioritize these essential metrics:

- Valuation Metrics: Use the P/E Ratio and Price-to-Book to find potentially undervalued stocks.

- Growth Metrics: Look at EPS Growth and Revenue Growth to gauge a company's future potential.

- Risk Metrics: Check the Debt-to-Equity ratio and Current Ratio to evaluate financial health.

How often should I use a stock screener?

Running a stock screen weekly or monthly works well. It helps you stay updated on market trends, get comfortable with the tools, and stick to a regular investment routine. Consistency is key to building a disciplined approach.

Are stock screener results completely reliable?

Stock screeners are helpful but have limitations:

- They rely on historical data, which might not capture sudden market shifts or company-specific events.

- Always conduct additional research before making any final investment decisions. [1][2]