AI tools are transforming stock research in 2025, offering faster, data-driven insights for smarter investing. Here are the 5 best AI platforms and what they do:

- Charli AI: Creates detailed equity research reports with real-time insights and automated portfolio management.

- Stocks to Buy Constellation: Analyzes 3,000 U.S. stocks with tools for trend forecasting and portfolio tracking.

- Danelfin: Uses an AI scoring system to rank stocks based on market outperformance potential.

- AltIndex: Focuses on alternative data like social media sentiment and ESG metrics for investment analysis.

- Trade Ideas: Real-time trading assistant with AI-powered alerts and strategy testing tools.

Quick Comparison

| Tool | Focus | Best For | Starting Price |

|---|---|---|---|

| Charli AI | Equity Research Reports | Long-term Investors | Contact for Pricing |

| Stocks to Buy Constellation | Stock Valuation & Analysis | Beginners & Professionals | $9/month |

| Danelfin | AI-Driven Predictions | Data-Driven Investors | Free (limited) |

| AltIndex | Alternative Data Analysis | ESG-Focused Investors | $29/month |

| Trade Ideas | Real-time Trading Signals | Active Traders | Subscription Required |

Each tool caters to different investment needs, from long-term analysis to active trading. Read on to find the one that suits your style and goals.

TOP 5 BEST AI Stock Trading Software, Apps, And Bots

1. Charli AI

Charli AI, highlighted as a Cool Vendor in Gartner's November 2024 report, delivers detailed equity research reports in just minutes, simplifying stock analysis with advanced AI technology [5]. Built for fast-moving markets, it equips investors with real-time insights and automated tools for smarter decision-making.

The platform dives deep into key metrics like sentiment analysis, buy/sell ratings, and fair market value, providing clear insights for portfolio management. By integrating directly with top financial data providers like Refinitiv Workspace, FactSet, and S&P Capital IQ, Charli AI gives users access to extensive financial datasets processed by advanced machine learning.

Its AI engine keeps a close eye on markets and portfolios, offering real-time updates and risk assessments. The platform also supports automated portfolio management, tailoring strategies to different investment approaches and risk levels. With robust security measures in place, it ensures compliance with financial regulations, making it a reliable choice for institutional investors [5].

Charli AI offers flexible pricing tiers for individual investors, professional traders, and large institutions. Features range from basic tools to enterprise-level analytics and custom integrations. To help users get the most out of the platform, it provides detailed tutorials and responsive customer support, catering to all levels of expertise.

Charli AI stands out as a leader in automating equity research, setting a strong benchmark for AI-powered stock analysis. Up next, we’ll look at Stocks to Buy Constellation, a tool focused on real-time trend forecasting.

2. Stocks to Buy Constellation

Stocks to Buy Constellation is reshaping how investors approach stock research by leveraging AI to simplify decision-making. This platform analyzes 3,000 U.S. stocks using advanced machine learning and natural language processing (NLP) to provide insights that help investors spot opportunities early.

Its AI engine reviews market trends, news sentiment, and economic data, offering tools to navigate even volatile markets. A proprietary valuation model enhances its ability to predict market movements with precision.

Here’s a breakdown of the subscription plans:

| Plan | Monthly Price | Features Included |

|---|---|---|

| Basic | $9 | 50 stock reports/month, portfolio tracking |

| Growth | $19 | 100 stock reports/month, full analytics suite |

| Premium | $49 | Unlimited reports, complete feature access |

The platform provides detailed metrics like risk-adjusted returns and benchmark comparisons, with options to export data for deeper analysis. Its industry analysis and macroeconomic tools shed light on sector trends and global economic shifts, equipping users to make well-rounded decisions.

Subscribers also receive an investment themes newsletter, which explains market movements and highlights emerging opportunities across various sectors. By integrating portfolio tracking, market analysis, and predictive tools into one platform, Stocks to Buy Constellation offers a comprehensive solution for investors.

Next, we’ll dive into Danelfin, a platform known for its AI-powered stock scoring system.

3. Danelfin

Danelfin is making waves in AI-driven stock analysis for 2025, offering advanced market predictions. The platform evaluates 10,000 features per stock every day, including over 600 technical indicators, 150 fundamental metrics, and 150 sentiment signals, delivering in-depth market insights.

Its standout feature is the AI Score, which ranks stocks from 1 to 10 based on their potential to outperform the market over three months. Between 2017 and 2022, a portfolio based on these predictions saw a 158% return - more than double the S&P 500's 70%. Unlike opaque systems, Danelfin provides clear explanations for the factors behind its stock ratings, helping investors make informed decisions with confidence.

Pricing Plans

Danelfin offers flexible pricing to suit different investor needs:

| Plan | Price | Key Features |

|---|---|---|

| Free | $0 | 10 stock reports/month, top 20 ranked stocks |

| Plus | $25/month or $204/year | Unlimited reports, full stock rankings |

| Pro | $70/month or $588/year | All trade ideas, advanced signals, data export |

"Pick the best stocks and optimize your portfolio with the power of our Artificial Intelligence." - Danelfin

The platform includes tools like diversity scoring, historical performance tracking, and daily AI Score alerts to refine investment strategies. It covers both US and European markets, offering a wide range of opportunities for portfolio diversification.

Danelfin is a great option for swing traders and long-term investors seeking transparency and reliable predictions. While it may be less ideal for day traders, the platform provides a 14-day free trial for its Plus and Pro plans, giving users a chance to explore its features.

Next, we’ll dive into AltIndex, a platform tailored for thematic investing and macroeconomic analysis.

sbb-itb-5d8d242

4. AltIndex

AltIndex blends traditional financial metrics with alternative data sources like social media sentiment, job postings, and app usage trends to provide investment insights. Its advanced AI algorithm processes this wide range of data, offering a detailed analysis of stock performance potential.

Independent financial analysts report that AltIndex achieves an 80% success rate on its stock recommendations [4]. The platform's stock predictor algorithm scans thousands of stocks daily, generating actionable buy and sell signals using a proprietary scoring system.

Performance Highlights

AltIndex has delivered impressive results in recent market predictions:

| Company | Signal Type | Outcome |

|---|---|---|

| Embraer (ERJ) | Buy | +136% gain from increased engagement metrics |

| American Express (AXP) | Buy | +64% gain following travel sector recovery |

| Amazon (AMZN) | Buy | +38% gain driven by digital growth trends |

Pricing Options

| Plan | Price | Features |

|---|---|---|

| Free Tier | $0 | Daily insights |

| Pro | $29.99/month | Advanced tools, full access |

The platform’s intuitive dashboard caters to both beginners and experienced investors. It includes powerful stock screening tools and real-time analytics. AltIndex also tracks portfolio performance and sends alerts for major shifts in company metrics or market trends.

By incorporating alternative data, AltIndex addresses the growing demand for non-traditional metrics in stock research. Its ability to integrate with leading trading platforms and financial data providers makes it a valuable resource for serious investors navigating today’s dynamic markets.

Next, we’ll dive into Trade Ideas, a platform known for its real-time trading alerts and AI-powered strategies.

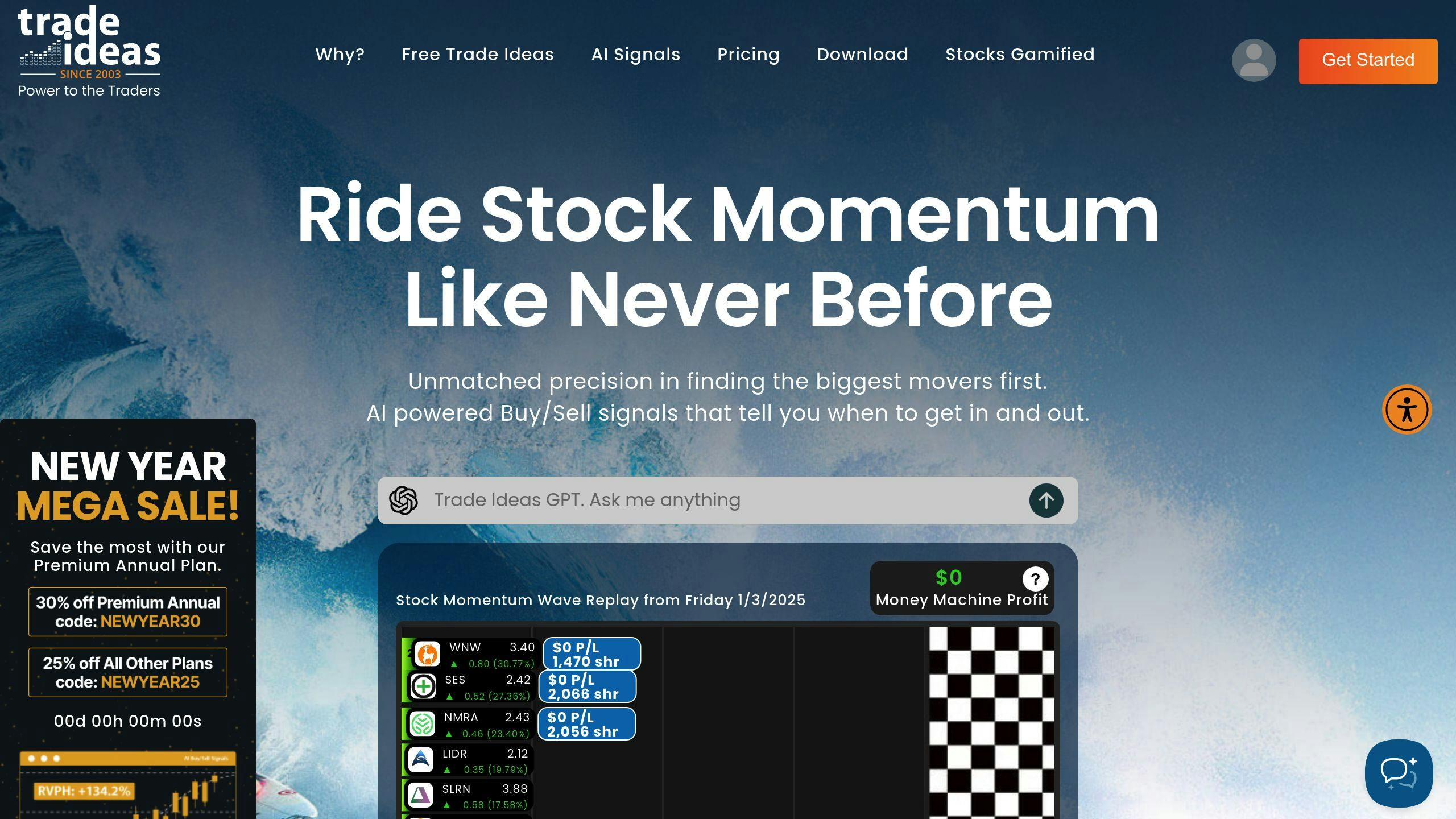

5. Trade Ideas

Trade Ideas is well-known for its AI-powered trading assistant, Holly. This bot analyzes market data in real-time, delivering actionable signals to help traders make quick, informed decisions.

Core Features

Trade Ideas offers a range of tools tailored for both day traders and swing traders:

| Feature | Description | Benefit |

|---|---|---|

| Holly AI Bot | Real-time scanning and alerts | Spots profitable opportunities fast |

| Backtesting Engine | Analyzes historical performance | Tests strategies before live trading |

| Simulated Trading | Paper trading environment | Lets you test strategies without risk |

| Custom Alerts | Monitors specific stocks/markets | Sends instant notifications |

Platform Integration

Trade Ideas works seamlessly with popular platforms like MetaTrader 5 (MT5) and NinjaTrader [1]. This integration supports smooth execution of strategies while harnessing AI-driven insights.

Advanced Analytics

The platform combines technical analysis with AI to deliver:

- Real-time market scans

- Pattern detection

- Risk management tools

- Performance tracking

Strategy Development

Traders can use Trade Ideas to create, test, and fine-tune strategies. The platform’s backtesting tools, simulated trading environment, and performance metrics make it easier to refine approaches before putting real money on the line.

Support and Resources

Trade Ideas provides a wealth of educational content, such as user guides, video tutorials, and professional support. These resources help users get the most out of the platform and improve their trading strategies.

Focused on active trading, Trade Ideas stands apart from traditional research tools. Its AI-powered features, testing capabilities, and robust support make it a top choice for traders who rely on data-driven decisions in fast-moving markets [1]. Among the tools reviewed, Trade Ideas shines for its emphasis on real-time trading and strategy optimization, complementing the broader analytical features offered by other platforms.

Comparison Table

Here's a breakdown of the top AI stock research tools, highlighting their main strengths to help investors pick the one that aligns with their trading style and goals:

| Feature | Charli AI | Stocks to Buy Constellation | Danelfin | AltIndex | Trade Ideas |

|---|---|---|---|---|---|

| Core Focus | Equity Research Reports | Stock Valuation & Analysis | AI-Driven Predictions | Alternative Data Analysis | Real-time Trading Signals |

| Key Features | - Portfolio Dashboards - Fair Market Value - Fundamental Analysis |

- 3,000 U.S. Stocks Coverage - Industry Analysis - Portfolio Tracking Bot |

- Stock Price Predictions - Portfolio Optimization - Risk Management |

- Social Media Sentiment - ESG Analysis - Stock Screener |

- Holly AI Bot - Backtesting Engine - Real-time Alerts |

| Performance | Strong in Fundamentals vs Sentiment Analysis | Daily Updated Data & Reports | 73% Outperformance vs S&P500 (2017-2023) | Alternative Data Insights | Real-time Pattern Detection |

| Best For | Long-term Investors | Both Beginners & Professionals | Data-Driven Investors | ESG-Focused Investors | Active Traders |

| Starting Price | Contact for Pricing | $9/month | Contact for Pricing | $29/month | Premium Subscription Required |

| Key Differentiator | Detailed Research Reports | Proprietary Valuation Model | Proven Performance Record | Alternative Data Integration | Real-time Trading Assistant |

Each platform caters to different investing needs. For example, Stocks to Buy Constellation is beginner-friendly with pricing as low as $9/month, while Trade Ideas is geared toward active traders with its real-time tools. On the other hand, Charli AI stands out for its in-depth fundamental research, and AltIndex appeals to ESG-conscious investors with its alternative data focus.

Conclusion

AI-powered stock research tools in 2025 have transformed how investors analyze markets and make decisions. These platforms have become essential for navigating the complexities of modern investing.

Each tool offers distinct features tailored to different investment styles. Charli AI is perfect for long-term investors with its detailed fundamental analysis. Stocks to Buy Constellation stands out for providing affordable, beginner-friendly insights on 3,000 U.S. stocks. Danelfin has delivered a strong performance, beating the S&P500 by 73% between 2017 and 2023. AltIndex focuses on alternative data and ESG factors, while Trade Ideas shines with its Holly AI bot, delivering real-time trading signals.

"AI-driven systems can boost profitability while managing risk systematically by continuously monitoring and adjusting asset allocations" [2]

As markets become increasingly complex, these tools equip investors with accurate, real-time insights. Their advanced algorithms and data-crunching abilities are now a cornerstone of effective investment strategies.

FAQs

Which AI tool is best for trading?

The right AI trading tool depends on your trading preferences and objectives. Here’s a breakdown of some popular options:

- Trade Ideas: Loved by day and swing traders, this platform features the Holly AI bot and real-time alerts. Known for its reliable AI-driven signals and backtesting tools, it’s a solid choice for active traders [1].

- QuantConnect: Perfect for quantitative traders and developers, this platform supports multiple programming languages and offers advanced tools for creating and testing strategies before going live [1].

- Stocks to Buy Constellation: A great pick for beginners and intermediate investors. It simplifies trading with AI-powered analysis, a portfolio tracking bot, and industry insights, making it ideal for those just starting out.

When evaluating AI trading tools, focus on features like:

- Real-time analytics and predictions

- Automated trading options

- Tools for processing both structured and unstructured data [1][3]